Proactive Security: Bagley Risk Management Tips

Proactive Security: Bagley Risk Management Tips

Blog Article

How Animals Risk Security (LRP) Insurance Policy Can Protect Your Animals Investment

Animals Risk Defense (LRP) insurance policy stands as a trusted guard versus the uncertain nature of the market, offering a calculated strategy to guarding your assets. By delving right into the details of LRP insurance coverage and its diverse benefits, livestock producers can fortify their investments with a layer of safety that goes beyond market variations.

Understanding Animals Threat Defense (LRP) Insurance Coverage

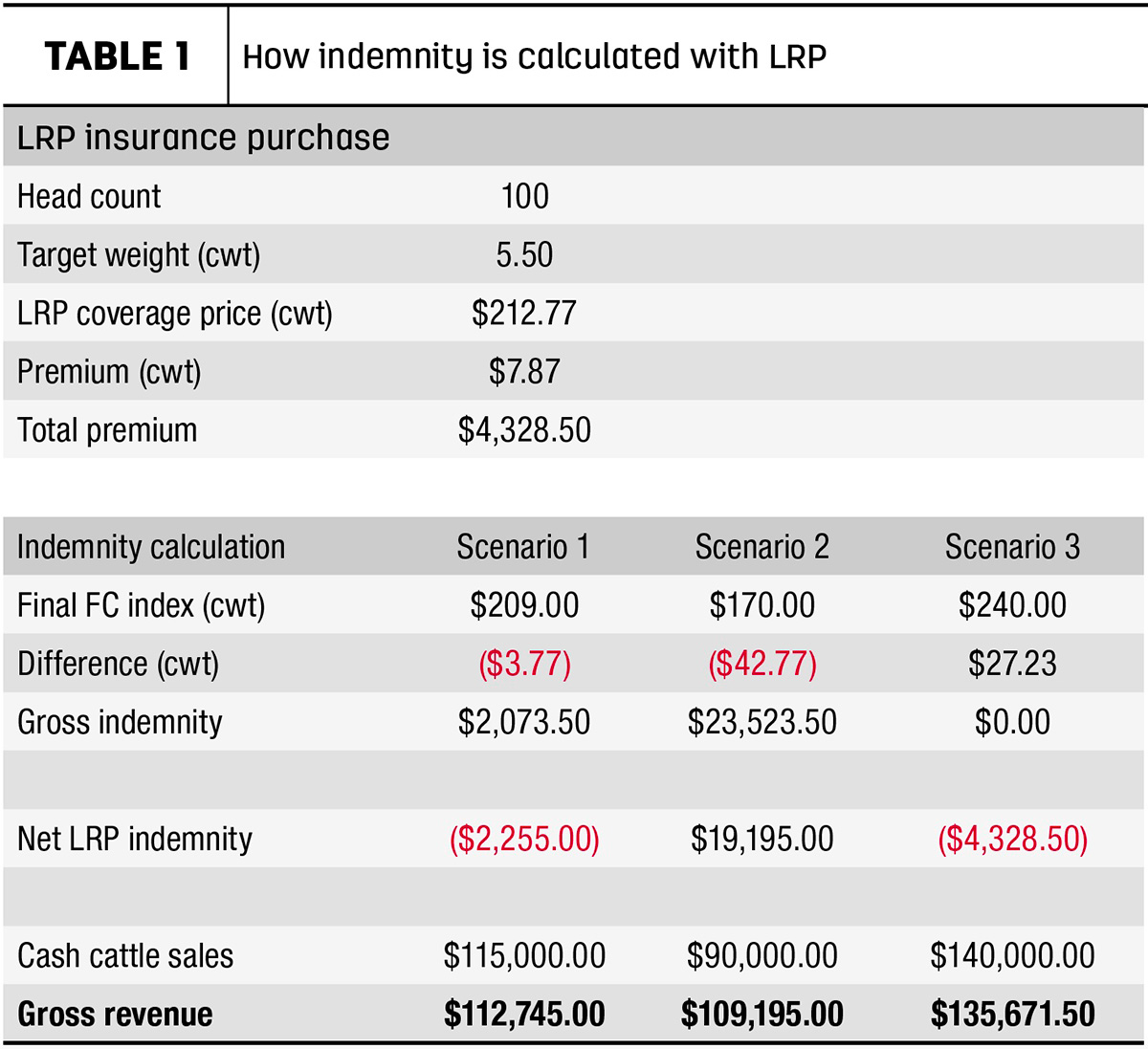

Comprehending Animals Threat Security (LRP) Insurance is essential for animals producers aiming to mitigate financial threats connected with price variations. LRP is a government subsidized insurance policy product designed to shield producers versus a decrease in market prices. By providing insurance coverage for market cost decreases, LRP assists producers secure a flooring price for their animals, guaranteeing a minimal level of earnings no matter market fluctuations.

One secret facet of LRP is its versatility, allowing manufacturers to personalize coverage levels and plan lengths to fit their certain needs. Manufacturers can pick the number of head, weight array, coverage cost, and coverage period that line up with their production goals and take the chance of tolerance. Recognizing these customizable choices is vital for manufacturers to efficiently manage their rate risk exposure.

Additionally, LRP is readily available for various animals kinds, including cattle, swine, and lamb, making it a flexible threat management device for livestock manufacturers across different markets. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make enlightened decisions to protect their investments and make certain economic stability when faced with market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Livestock manufacturers leveraging Animals Risk Protection (LRP) Insurance obtain a tactical benefit in securing their financial investments from price volatility and protecting a steady financial footing among market unpredictabilities. By setting a flooring on the cost of their livestock, manufacturers can minimize the danger of significant economic losses in the occasion of market slumps.

In Addition, LRP Insurance provides producers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for animals manufacturers are significant, supplying a beneficial tool for managing risk and ensuring financial security in an unpredictable market environment.

How LRP Insurance Mitigates Market Risks

Reducing market dangers, Livestock Threat Security (LRP) Insurance coverage provides animals manufacturers with a reputable shield versus cost volatility and financial unpredictabilities. By using protection versus unforeseen price declines, LRP Insurance aids manufacturers protect their investments and keep financial security when faced with market changes. This type of insurance allows livestock manufacturers to secure a cost for their pets at the start of the plan period, making certain a minimal price degree despite market changes.

Steps to Protect Your Livestock Investment With LRP

In the realm of agricultural risk administration, applying Animals Threat Security (LRP) Insurance coverage entails a critical procedure to guard financial investments versus market fluctuations and uncertainties. To protect your livestock investment efficiently with LRP, the first step is to analyze the specific risks your procedure encounters, such as cost volatility or unforeseen weather occasions. Recognizing these threats permits you to determine the protection degree required to shield your investment appropriately. Next, it is important to view research and select a reputable insurance company that supplies LRP policies tailored to your livestock and service needs. Once you have chosen a provider, very carefully evaluate the plan terms, conditions, and insurance coverage limitations to ensure they straighten with your threat monitoring objectives. Additionally, frequently checking market fads and changing your coverage as needed can aid maximize your protection versus potential losses. By complying with these actions vigilantly, you can enhance the safety of your livestock investment and browse market unpredictabilities with confidence.

Long-Term Financial Security With LRP Insurance

Guaranteeing enduring monetary security through the application of Animals Threat Protection (LRP) Insurance is a sensible long-lasting method for agricultural producers. By incorporating LRP Insurance policy right into their threat administration plans, farmers can protect their livestock financial investments versus unforeseen market fluctuations and negative events that could threaten their economic wellness gradually.

One key benefit of LRP Insurance policy for lasting monetary safety and security is the peace of mind it supplies. With a reliable insurance coverage in position, farmers can mitigate the monetary risks linked with unpredictable market problems and unexpected losses as a result of aspects such as you could try here disease episodes or natural calamities - Bagley Risk Management. This security enables producers to concentrate on the day-to-day procedures of their livestock organization without continuous fret about possible monetary setbacks

Additionally, LRP Insurance gives a structured approach to handling threat over the long-term. By establishing particular coverage levels and picking proper recommendation periods, farmers can customize their insurance prepares to straighten with their financial objectives and risk tolerance, ensuring a protected and lasting future for their animals procedures. Finally, spending in LRP Insurance coverage is a positive strategy for agricultural producers to attain long lasting monetary security and safeguard their resources.

Verdict

In final thought, Livestock Risk Protection (LRP) Insurance is a beneficial tool for livestock manufacturers to alleviate market dangers and safeguard their financial investments. It is a wise selection for guarding animals financial investments.

Report this page